UK's GDP Resurgence: What the Latest Data Means for Investors

Amidst the dynamic world of finance, the UK's GDP figures for the second quarter and June have taken center stage, igniting discussions among analysts and traders worldwide. What do these figures mean for the UK's economic trajectory, and how might they reshape investment strategies? Let's delve in.

In the financial epicenter today, all eyes were on the clock as it ticked towards 7:00 Greenwich Time. The UK released its Gross Domestic Product (GDP) figures for both the second quarter (YoY) and the month of June (MoM). Analysts and traders alike held their collective breath, and when the numbers were unveiled, a glimmer of optimism was evident in the markets. Let’s dissect these numbers and consider their potential implications for the broader financial landscape.

Understanding the Data

The preliminary GDP reading for Q2 (YoY) marked at 0.4% significantly exceeded the forecasted 0.2%. This, combined with the previous reading of 0.2% for Q1, presents a promising narrative: could the UK's GDP have found its floor and now be on the rise?

Furthermore, the GDP for June (MoM) witnessed an uptick of 0.5%, juxtaposed starkly against its prior reading of -0.1% and surpassing the forecasted 0.2%.

Important: GDP is a primary indicator of an economy's health; when it exceeds expectations, it's a positive sign.

Historical Data & Its Relevance

Considering the historical GDP (QoQ) readings:

- Jun 30, 2023 (Q1) - 0.1%

- Mar 31, 2023 (Q4) - 0.1%

- Dec 22, 2022 (Q3) - -0.3%

- Sep 30, 2022 (Q2) - 0.2%

- Jul 13, 2022 (Q1) - 0.4%

- Mar 31, 2022 (Q4) - 1.3%

- Dec 22, 2021 (Q3) - 1.1%

One can see the undulating journey the UK economy has traversed. From the highs of 1.3% in early 2022 to the dip in late 2022 and early 2023, the current figures suggest we might be witnessing the beginning of a resurgence.

Interesting Fact: The UK GDP saw three consecutive quarters of negative growth during the 2008 financial crisis.

Interpreting the Economic Signals

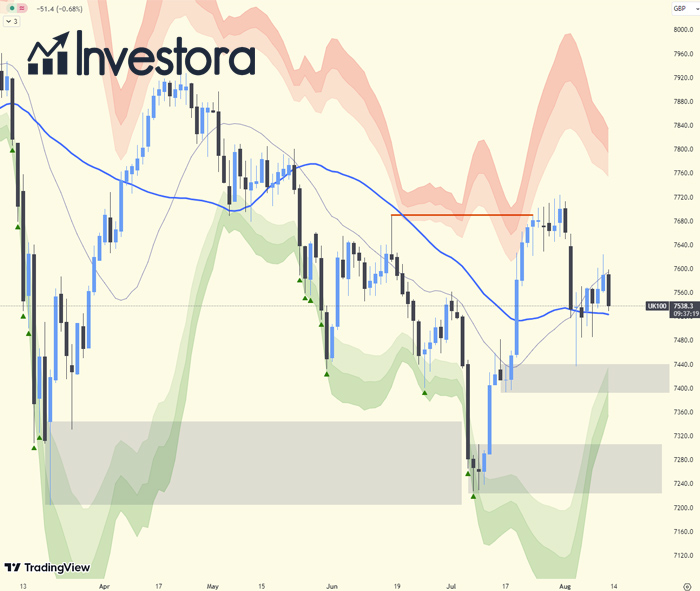

- GBP Strength: A favorable GDP reading often translates to bullish sentiments around the domestic currency. If the UK’s economy continues on this upward trajectory, the GBP might see reinforcement against other major currencies.

- Stock Market Landscape: The ripple effect of positive GDP numbers frequently invigorates the stock market. Companies interwoven with the UK's domestic economy, particularly those in sectors like retail, services, or real estate, might witness increased investor interest and stock valuation.

- ETFs and Fund Maneuvers: Funds and ETFs with a concentration in UK assets could experience enhanced capital inflows. For investors who believe in the UK’s economic rebound, these could offer a diversified exposure.

Tip: Watch for industries that benefit most from positive GDP data, like manufacturing and services.

Strategizing Investments

For traders and investors, these figures are opportunities in disguise. Here's a strategy blueprint:

- Forex Arena: The GBP, in the short run, could find bullish momentum, especially against its primary counterparts.

- Equities Domain: UK-rooted companies, especially in sectors showing signs of post-pandemic recovery, may offer profitable entry points.

- Long-Term Play: With a resurgence in sight, diversifying into UK-centric ETFs or mutual funds might be a strategy to consider, banking on sustained growth.

Remember: Investment strategies should be regularly revisited and revised based on fresh economic data.

The Investment Climate

With inflation seemingly on a leash and the GDP numbers hinting at an economic renaissance, the UK might be opening its doors wide for investments. However, caution should be every investor’s companion. While indicators suggest a potentially perfect time to delve into UK stocks, one should conduct thorough research and seek expert counsel.

The narrative of the UK's economic landscape is evolving, and Investora remains committed to shedding light on its every contour. Keep investing smartly and stay tuned for more insights!

Interesting Fact: The UK holds the sixth position in the world in terms of nominal GDP.

Frequently Asked Questions

How do GDP figures influence the stock market?

Strong GDP figures generally boost investor confidence, potentially leading to stock market rallies, especially within sectors closely tied to domestic growth.

How does a country's GDP impact its currency strength?

A robust GDP can signal a healthy economy, which in turn can strengthen the country's currency as it becomes more attractive to foreign investors.

When is the best time to invest based on GDP data releases?

While positive GDP data can signal a good time to invest, it's crucial to consider other economic indicators, market sentiment, and individual investment goals.

How does inflation relate to GDP growth?

Inflation and GDP are closely linked. While moderate inflation is often seen in a growing economy, high inflation can hinder consumer spending and economic growth.

Should I solely rely on GDP figures for investment decisions?

No, while GDP is a crucial indicator, diversifying your information sources and considering other economic indicators will provide a more holistic view.

With the recent GDP figures painting an optimistic picture of the UK's economy, investors and traders are presented with an array of opportunities. While the signs are promising, strategic investments, backed by comprehensive research and a deep understanding of historical data, will be key. Investora will continue to shed light on the evolving UK economic narrative, guiding you every step of the way.

- Share this article