The Interplay of Job Growth and Work Hours in the U.S. Post-Pandemic

As we emerge from the cataclysm of the COVID-19 pandemic, America's labor market showcases a strange paradox: booming job numbers yet dwindling work hours.

Despite the fact that hiring is on an upward trajectory and unemployment is inching close to record lows, the average working hours of Americans remains curiously lower than pre-pandemic levels.

Interesting Fact: Unemployment in America is near record lows post-pandemic, yet the average work hours are significantly lower than before the pandemic.

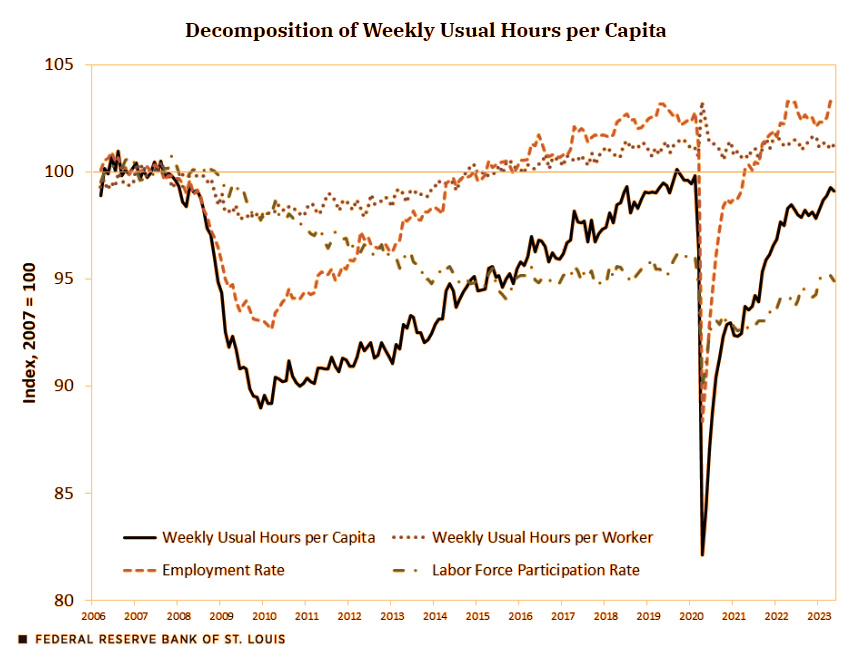

The Federal Reserve Bank of St. Louis recently shed light on this puzzling anomaly. Economists Serdar Birinci and Trần Khánh Ngân put forth a compelling study showing that average hours worked per individual in the U.S. have been slower to regain their pre-COVID momentum, unlike the employment rate which bounced back impressively and is currently trending above the pre-pandemic norms.

The study employed an index, with 2007 average levels marked as 100, to track the shifts in employment rates and hours worked. It's important to understand that the employment rate, often seen as the counterpart to the more commonly referred unemployment rate, indicates the proportion of the workforce that's currently employed.

Tip: Consider demographic shifts such as retirement rates when analyzing labor market trends, as these can significantly impact workforce composition and working hours.

One key takeaway from the study points to a significant decrease in the total working hours. The reason for this decline is primarily due to a surge in retirements during the pandemic, reducing the proportion of the working population. This sudden retirement wave predominantly consisted of older workers who are yet to return to the workforce.

However, there is a glimmer of hope. The hours-worked-per-capita statistic seems to be on a much quicker recovery route than it was during the aftermath of the Great Recession. This could potentially signal a gradual return to normalcy, albeit at a slower pace than the job market rebound.

Given the scope and impact of the pandemic, these findings have significant implications for traders and investors alike. Understanding these labor market dynamics can offer useful insights for investment decisions and strategies in a post-pandemic world.

Remember: The job market rebound is outpacing the recovery in work hours, which could have various implications for market strategies.

Frequently Asked Questions

How does this labor market trend impact my trading strategy?

Given the slower recovery of work hours, it's prudent to consider sectors that may be impacted by a reduced workforce. Industries heavily reliant on human labor may see slower growth, which could influence your trading decisions.

How does this trend compare to the recovery from the Great Recession?

The hours-worked-per-capita statistic is recovering at a faster rate post-pandemic compared to the recovery from the Great Recession. This could indicate a more resilient economy in the current scenario.

What does the decrease in work hours mean for the economy?

A decrease in work hours could potentially lead to slower economic growth as fewer hours worked translates to less output. However, it's crucial to consider other factors like increased automation and remote work efficiencies.

How might the retirement wave impact the labor market in the long run?

The wave of retirements could lead to labor shortages in certain sectors, potentially driving up wages. On the other hand, it may also accelerate the adoption of automated technologies.

Could the decrease in work hours influence inflation?

With fewer people working, labor shortages could drive wages and subsequently, prices up. Traders should keep a close eye on inflation trends, as they could impact the overall market and individual securities.

Important: The recovery trend in work hours post-pandemic is proving to be quicker than after the Great Recession, suggesting potential signs of a gradual return to normalcy.

- Share this article