IBM's Stellar Earnings Reflect Market Optimism for AI Solutions

IBM's fiscal 2023 second-quarter results demonstrated its resilience amidst a challenging business climate, marked by an impressive earnings beat and a notable rise in demand for its artificial intelligence (AI) products. The technology powerhouse's shares soared in response to the encouraging announcement.

The second quarter of fiscal 2023 proved to be a milestone for IBM (IBM), with the company reporting earnings of $2.18 per share. While overall revenue slightly contracted by 0.4% to $15.48 billion, narrowly missing analysts' expectations, the adjusted gross margin came in at a higher-than-anticipated 55.9%.

Remember: IBM's impressive performance in fiscal 2023 Q2 is marked by an earnings beat and a significant rise in demand for its AI solutions.

Key factors driving IBM's profitability during the quarter included the success of cost reduction measures, an improved product mix, and rising client demand for AI solutions. James Kavanaugh, the Chief Financial Officer (CFO), underscored that the improved gross margin was a direct outcome of "our improving portfolio mix and productivity initiatives." As part of these productivity initiatives, IBM undertook a significant workforce reduction of 3,900 earlier in the year.

Software and consulting revenue proved to be another bright spot, recording respective increases of 7.2% to $6.6 billion and 4.3% to $5 billion. The news was not as rosy for the Infrastructure unit, which houses IBM's mainframe computers. It experienced a revenue decline of 14.6% to $3.6 billion.

Tip: Companies that take active steps to reduce costs, improve their product mix, and leverage emerging technology trends can greatly enhance their profitability.

With the increasing adoption of AI solutions across industries, IBM has made this a central focus. CEO Arvind Krishna pointed out that more customers are turning to AI to "transform their operations." He also highlighted IBM's commitment to addressing the growing client need for "trusted, enterprise AI solutions." Krishna expressed enthusiasm about the market response to IBM's new AI platform, "WatsonX," which he said demonstrated a clear market appetite for such technology.

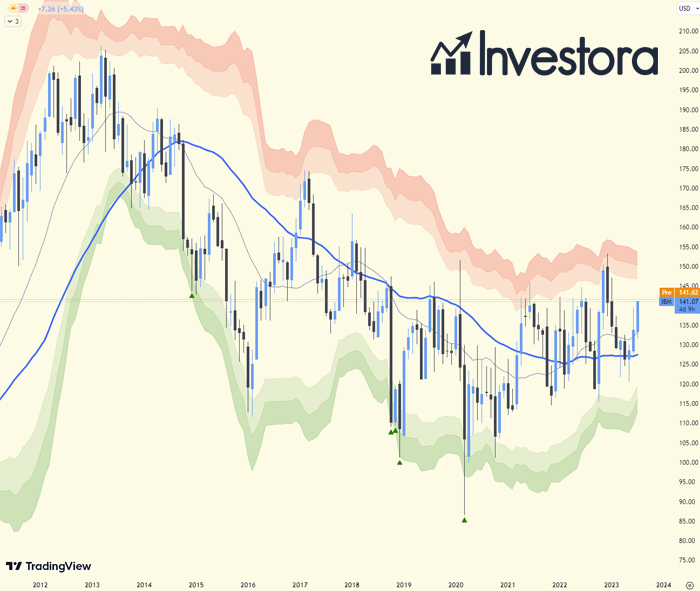

IBM shares saw a boost of about 3% in early trading following the earnings release, though they still remain roughly 1% below breakeven for the year. Yet the company's commitment to innovation and resilience amidst challenges suggests it remains a compelling option for investors.

Interesting Fact: More and more customers are using AI to transform their operations, indicating a significant shift towards AI-centric solutions in the business world.

Frequently Asked Questions

How might this news affect trading of IBM shares?

IBM's earnings beat and positive developments with its AI products could potentially make its shares more attractive to investors, resulting in increased trading activity.

How does IBM's focus on AI products impact its future business outlook?

IBM's increasing focus on AI indicates its strategic direction and could potentially open up new revenue streams, possibly leading to improved future earnings.

What does the increased demand for AI products mean for the tech industry?

The rising demand for AI products could signal a larger shift in the tech industry towards AI-centric solutions, offering significant opportunities for companies invested in AI technologies.

How could IBM's improved gross margin affect its financial stability?

An improved gross margin suggests that IBM is effectively managing its costs, which could lead to enhanced financial stability and make it an attractive prospect for investors.

Tip: Positive earnings releases often lead to a surge in a company's share price, making them crucial events for traders and investors.

- Share this article