Bitcoin, Ether CME Futures: Q2 Sees Record Large Trader Interest

In the vibrant world of cryptocurrency, Q2 of 2023 marked a new record. Large-scale traders showed unprecedented interest in Bitcoin and Ether CME futures, as announced by the Chicago Mercantile Exchange (CME), a derivatives behemoth known for its regulated trading products.

Fuelled by institutional interest and an urgent need for risk mitigation tools against the backdrop of surging market volatility, Bitcoin futures popularity rose steadily throughout the quarter. The CME confirmed that the average number of sizeable open interest holders, defined as entities holding at least 25 bitcoin futures contracts, reached a new high of 107.

Interesting Fact: In Q2 2023, the average number of entities holding at least 25 Bitcoin futures contracts reached a record high of 107

Ether futures echoed this trend, with large open interest holders averaging 62 throughout Q2. This highlights the increasing confidence and reliance of institutional investors on regulated venues to shield their investments from market fluctuations, accentuating the robustness and demand for such products.

Governed by the Commodity Futures Trading Commission (CFTC), CME's futures have a standard bitcoin contract equivalent to 5 BTC, while the micro contract amounts to a tenth of 1 BTC. For ether futures, the standard contract size is 50 ETH, and micro futures equate to one-tenth of 1 ETH.

CME's regulated and cash-settled futures have been a long-standing favorite among institutions seeking cryptocurrency exposure without the need for direct ownership. This preference led to a record-breaking participation from large holders in Q2, occurring in tandem with leading cryptocurrencies continuing their Q1 rally.

Fact: Q2 saw a record-breaking participation from large holders, in sync with the continuation of Q1's cryptocurrency rally.

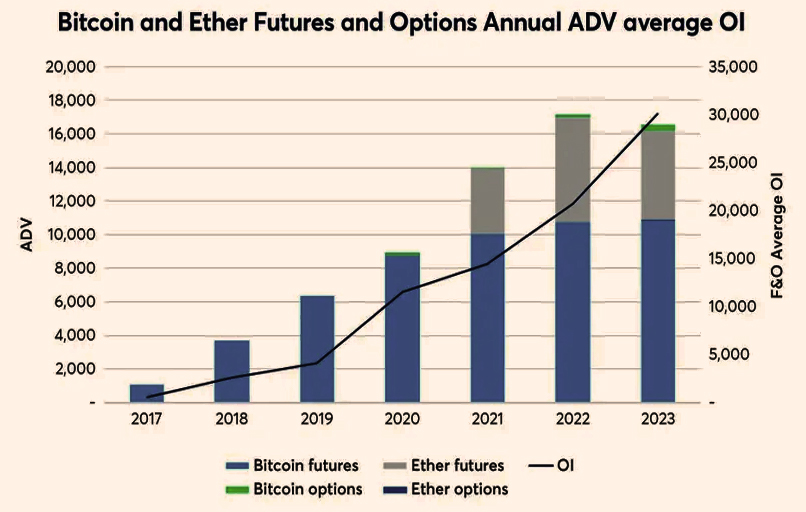

Over the three months to June, Bitcoin recorded a 7% rise, securing an 84% increase for the year's first half. Ether wasn't far behind, demonstrating a 61% gain in the first six months. Alongside the rising prices, the demand for hedging tools sparked a surge in trading volumes and open interest in BTC and ETH futures and options, with CME reporting all-time highs in H1.

Exploring the specifics, the open interest in standard bitcoin futures contracts averaged a record 14,800 contracts through H1, up 15% from 2022. Additionally, bitcoin options saw an average open interest of 9,400 contracts, signifying an extraordinary 175% rise compared to the previous year.

As part of its ongoing expansion, CME plans to introduce futures linked to the ether-bitcoin ratio later this month, pending regulatory approval. It's also boosting its options product suite with weekly bitcoin and ether expiries, further enhancing its diverse offerings to meet the evolving needs of traders.

Remember: Bitcoin options experienced an impressive rise in average open interest, marking a 175% increase compared to the previous year.

Frequently Asked Questions

How can traders capitalize on this news?

Traders can consider engaging in futures contracts for bitcoin or ether, as it indicates growing institutional interest. However, thorough analysis and understanding of market trends and risk factors are essential before making any investment decisions.

What does the rising interest in Bitcoin and Ether futures signify for traders?

This rise in interest signifies increased institutional trust in cryptocurrencies and indicates an influx of new money into the market. It also presents potential opportunities for increased liquidity and investment diversification.

How do CME's plans to introduce new products affect traders?

CME's plans to introduce futures linked to the ether-bitcoin ratio and weekly bitcoin and ether expiries are likely to provide traders with more investment options and flexibility, opening up potential hedging and speculation opportunities.

Why is this growing interest in Bitcoin and Ether futures important?

The growing interest is important as it shows the maturing of the cryptocurrency market and its growing acceptance among institutional investors. This could lead to increased stability and predictability in the market, benefiting all traders.

Tip: With the upcoming launch of futures linked to the Ether-Bitcoin ratio, investors should consider diversifying their investment portfolio to include these new futures contracts.

- Share this article