The Intricacies of Investing in Gold: A Comprehensive Study

Embarking on an exploration into the realm of financial investments, this article illuminates the various aspects of gold as an investment tool, including its performance, historical context, and influence in a diversified portfolio. We delve into the periods when gold outshines other assets and the times when it doesn't hold its luster, while keeping a keen eye on its performance against other investments. Unveil the mysteries of gold investing with Investora.

Understanding Gold as an Investment Tool

Regarded as a bulwark during turbulent financial times, gold is a unique asset. The yellow metal does not follow the conventional market fluctuations and is often considered a haven during market declines. However, gold's independence from standard market trends also brings with it an element of risk. Instances from history reveal that gold prices don't always escalate, especially during thriving markets, leaving investors to grapple with the paradox of gold being a safe yet risky investment.

Investing in gold presents a distinct set of challenges. Unlike traditional income-generating assets such as stocks and bonds, the return on investment in gold relies entirely on price appreciation. Gold also necessitates unique costs. As a tangible asset, it invites storage and insurance charges. Despite being a safe haven traditionally, gold can experience high volatility and undergo a price drop.

Remember:

Gold doesn’t align with regular market prices.

Gold investment is based solely on price appreciation, not income generation.

Physical gold requires storage and insurance, incurring additional costs.

Gold in a Diversified Portfolio

Despite the inherent challenges, gold can prove to be a valuable component in a diversified portfolio, primarily as a hedge during falling stock markets. A comprehensive review of gold's performance over time yields a more nuanced perspective on its role as an investment tool.

Key Points:

Gold is a time-tested store of value and a shield against inflation.

Over the long haul, stocks and bonds have generally surpassed gold's price appreciation.

During specific shorter periods, gold can emerge as the top performer.

Gold prices often surge during times of high inflation and geopolitical unrest.

The examination of gold's performance over varying time frames reveals a complex picture. For instance, during some 30-year periods, stocks have outperformed gold and bonds. Conversely, during certain 15-year periods, gold has overshadowed stocks and bonds.

Peek into Gold's Historical Performance

Tracing the trajectory of gold prices, from the Gold Reserve Act in January 1934 to President Richard Nixon's decision to shut the U.S. gold purchase window in August 1971, gold was effectively priced at $35 per ounce. This era had notable repercussions on gold investment, primarily due to President Franklin D. Roosevelt's mandate for citizens to trade in gold bullion, coins, and notes for U.S. dollars, which made investing in gold a formidable challenge.

Interesting Fact: From 1934 to 1971, gold was effectively priced at $35 per ounce, making gold investment a significant challenge during this period.

Investing in gold became much more accessible following these policies, leading to significant price appreciation. Comparing the fixed gold price of $35 to the price of $2,000 per ounce in Q1 2022, gold's price appreciation calculates to a whopping 5,700%. From 1971 to Q1 2022, the DJIA's value appreciation stands around 4,500%.

Gold versus SP500: A Comparative Analysis

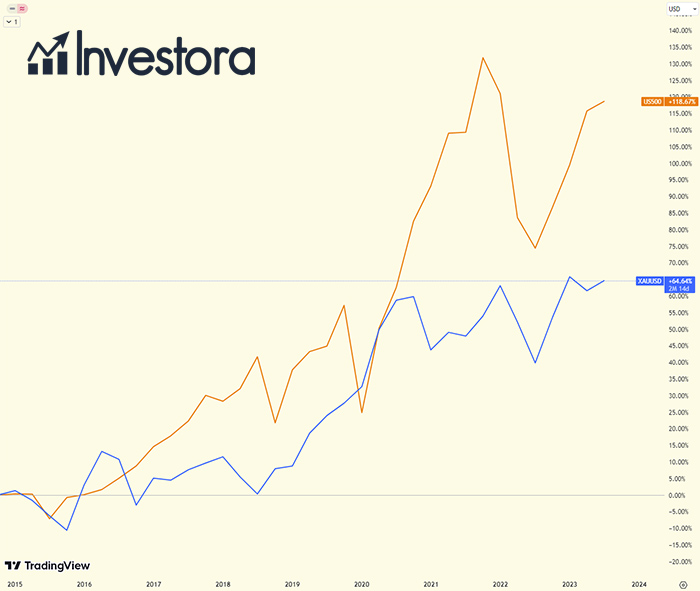

Despite the alluring prospect of gold investment, especially during turbulent economic times, it's worth noting that other investment vehicles can offer superior returns. To illustrate, let's consider the SP500 index. A comparison of the performance of gold (XAUUSD) and the SP500 (US500 CFD contract) from 2015 to the present day (16th July 2023) shows that the SP500 index has almost doubled the gains of gold. Gold's increase during this period stands at +64.64%, while the SP500 has gained an impressive +118.67%.

This comparison underlines an important investing lesson. While gold undoubtedly holds an important place in a well-diversified portfolio, it should not be the only focus. Index funds like the SP500, which track the performance of a large number of companies, can often provide more significant returns, especially during a bullish market. However, keep in mind that the performance of individual assets can vary greatly from year to year, and past performance is not always indicative of future results.

Remember: From 2015 to 16th July 2023, gold (XAUUSD) has gained +64.64%, while the SP500 (US500 CFD contract) has increased by +118.67%.

Therefore, while investing in gold can be a safe bet during market uncertainty, other forms of investments like the SP500 index can offer potentially higher returns during bullish market conditions. Diversification, hence, remains key to a successful investment strategy, balancing risk and reward by investing in a mix of assets.

Unveiling Gold's Return on Investment

The returns on gold investments can fluctuate considerably, contingent upon the time frame in focus. For instance, from January 1971 to December 2019, gold yielded average annual returns of 10.6%, trailing slightly behind global stocks, which returned 11.3%. However, in 2020, gold's annual average return rocketed to 24.6%, making it the second-highest returning asset, outshined only by silver.

- Gold's average annual returns from 1971 to 2019 were 10.6%.

- In 2020, gold's annual average return rose to an impressive 24.6%.

In a thriving stock market, gold investments tend to underperform. This underperformance stems from gold's lack of income generation or growth representation in any company or sector. Instead, gold's value lies in its relative scarcity and its historical value precedent. Therefore, during times of economic prosperity and strong corporate performance, stocks usually attract more investors than gold.

Gold vs. Cryptocurrency: A Comparison

The introduction of Bitcoin (BTC) in 2009 brought a significant shift in the investment landscape. Bitcoin has largely outperformed most other asset classes, including gold, escalating from less than $1 to several thousand dollars. Owing to its scarcity and a controlled and diminishing rate of new supply, Bitcoin and other cryptocurrencies have often been likened to a form of digital gold. However, over the last two years, gold has managed to outperform cryptocurrencies, primarily due to the bear market hitting Bitcoin and other digital currencies in 2022.

Interesting Fact: Over the past two years (2021-2022), gold has outperformed cryptocurrencies, despite the impressive performance of Bitcoin since its inception.

The Key to Successful Gold Investment

Investing in gold is not without its risks. Its price, much like stocks and bonds, is subject to fluctuations influenced by a myriad of factors in the global economy. Therefore, considering the time frame of investment and analyzing market research are critical to gauge market performance expectations.

Diversification is the cornerstone of any successful investment strategy, and gold can be an integral component in achieving that diversification, especially during market downturns when gold prices often increase.

Key Points:

Consider the time frame for investing in gold.

Conduct thorough market research to understand market performance expectations.

Diversification is vital in any investment portfolio, and gold can be an essential part of that diversification strategy.

This comprehensive study of gold as an investment tool explores its unique role in a diversified portfolio, performance over various periods, and comparison with other investments such as stocks, bonds, and cryptocurrencies. Gold's historical context provides valuable insights into its performance as an investment, emphasizing the need for diversification in any investment strategy. Despite its potential drawbacks, gold continues to hold its weight as a valuable investment tool, especially during market declines. Remember, as with any investment, it's vital to consider the time frame and study market research to gauge an understanding of how markets are expected to perform.

- Share this article